By Dan Byrne for AMLi

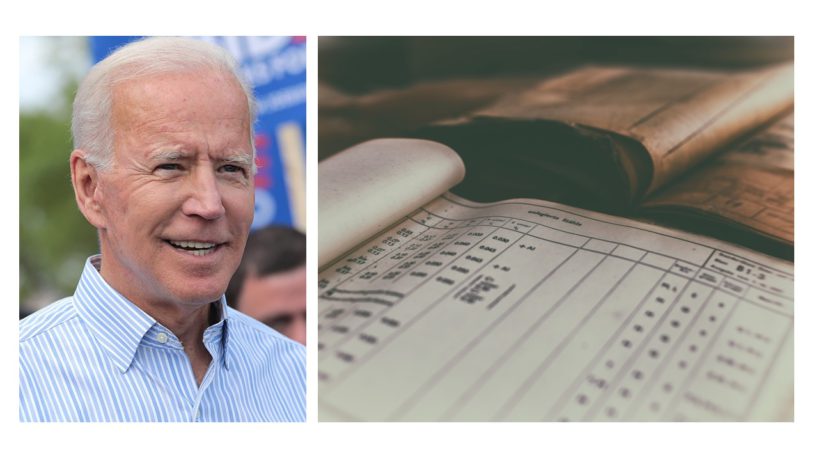

A FULL beneficial ownership registry is a key demand of AML experts of incoming US President Joe Biden.

So will it be it be a priority of the incoming administration and if so what are the chances any proposals on a registry will get through a very partisan Congress?

Two experts on the scene gave their views at this week’s Fincrime World Forum.

Financial Integrity Network Vice President Tommy Iverson and CCO and Co-Founder of financial advisory firm Elementaryb Denisse Rudich both expressed their hopes that a full beneficial ownership registry would soon be operational in the US.

For Iverson, the issue was not as dependent on American politics as the current polarised landscape may suggest.

“Combatting financial crime is generally a bipartisan issue. Whichever administration is in power, there’s general support across these issues, which I think is great,” he told the Forum.

He also pointed to the fact that despite the much-discussed transfer of power from Donald Trump to Joe Biden, the two houses of the US Congress were likely to remain controlled by the same party as they were before the election.

This would mean that legislation for beneficial ownership registries – which was already making its way through congress – will likely continue to progress as planned.

“The fact that parties are remaining in control of each of those chambers could signal that it is just as likely to move forward in the next congress as in this one,” he advised.

“There has been so much research, investigation and discussion on this issue… I would hope this means there’s a great chance of doing it, and getting it right!”

Meanwhile, Rudich also heaped praised on the plans for a robust registry for the United States, stressing that she – and colleagues in her line of work – had been waiting for one for some time.

She cautioned, however, that it was not clear what kind the registry would look like in terms of publicly available details, or who would be able to access it.

“Will it be a fully public beneficial ownership register? Or will it be similar to Europe with paywalls in place, or ones where only supervisors can access information?”

“I’m aware of the dangers of fully transparent beneficial ownership registries,” she told the forum. “Where you could look up anyone who is the owner of a business and see their personal details.”

Separately, both experts also strongly welcomed the presumptive nomination of former Federal Reserve Chair Janet Yellen to the post of Secretary of the Treasury – the first woman to hold the position, should she be confirmed.

“She is going to be a Treasury Secretary that we have been wanting for a while,” said Rudich. “She has experience, and the ability to bring that experience and loyalty from her peers.”

Iverson echoed those sentiments, saying that Yellen had done “an amazing job,” in previous roles. However, he said that the future was not just about her.

“What I know is that there are also many incredibly smart career civil servants in the Treasury that are ultimately committed to combatting financial crime,” he told the Forum. “They will be there to continue to steer the ship from a substantive perspective.”

Share this on:

Follow us on: