By PAUL O’DONOGHUE, Correspondent

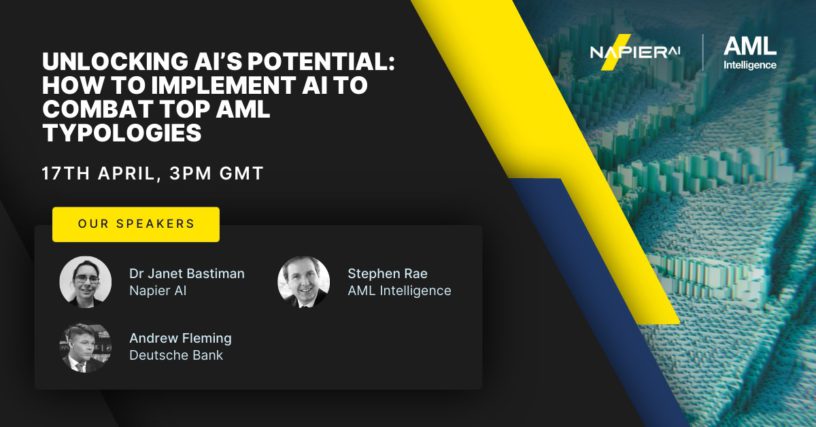

THE COUNTDOWN is on to our special webinar ‘How to implement AI to combat top AML typologies’ on Wednesday next.

The session – in collaboration between AML Intelligence and Napier AI – will look at screening throughout the client lifecycle, something which is crucial for meeting the needs of regulators.

The event on April 17 will examine how to implement AI to combat top AML typologies. It will be moderated by AML Intelligence’s Stephen Rae.

The event will also hear the expert insight from Napier AI’s Dr. Janet Bastiman on the optimal path to AI implementation.

Janet is Chair of the Royal Statistical Society’s Data Science and AI Section and member of FCA’s newly created Synthetic Data Expert Group, as well as Napier AI’s Chief Data Scientist.

Andrew Fleming, the MI & Reporting EMEA Head at Deutsche Bank, will also participate as a panellist.

Andrew Fleming is an expert in financial crime risk, specialising in investigating cross-border financial crimes carried out by criminal groups, including terrorist organisations. Before taking up his position at Deutsche Bank, he worked for HSBC in the roles of Global Compliance MI Senior Business Partner and Global AML Risk Framework Manager.

He has collaborated with various international law enforcement agencies such as Eurojust, FBI, AFP, and the IRS.

With a strong background in cybercrime and public speaking, Fleming is experienced in delivering training and presentations on topics like terrorist financing, fraud, and money laundering to law enforcement personnel, international forums, and conferences.

He has emphasised the importance of leveraging technology for businesses to enhance their financial crime risk management strategies.

Stephen Rae previously said the applications of AI for financial crime compliance are “game-changing”.

“[It] can facilitate unparalleled operational efficiencies and transform your organisation’s compliance function,” he said.

“In this webinar, we discuss the recommended process for AI implementation in client screening in the current regulatory landscape around the use of AI,” he added.

The event takes place on Wednesday, April 17 next at 15.00 GMT.

To secure your place at this expert briefing, register HERE.