By ALISHA HOULIHAN for AMLi

DUBLIN has emerged the favourite city amongst Anti-Financial Crime (AFC) professionals to host Europe’s new AML Authority (AMLA).

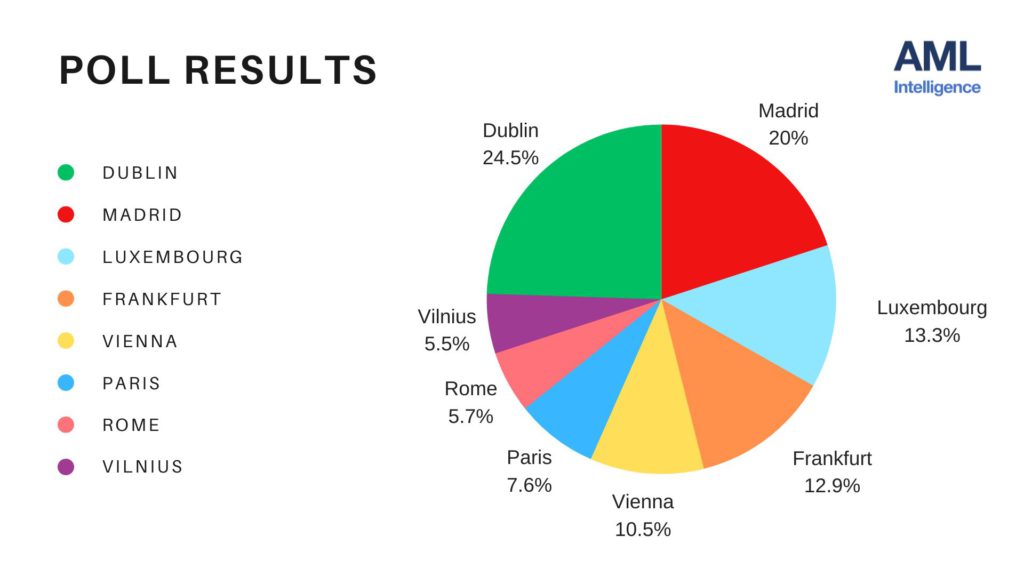

In a poll the Irish capital received almost 25pc (24.5pc) of votes when asked which city would make the best location for the Authority.

AMLA is expected to grow to 750 staff and could lead to up to 10,000 support jobs in compliance departments of banks and other related industries which will migrate to the authority’s host city. The agency will have a budget of some €450M, partly funded by a levy on EU banks.

Voters were given the choice of eight bidding cities to choose from and 2,255 people participated. The poll was conducted by AML Intelligence over the period of one week.

Madrid came second securing 20pc (450 votes) followed by Luxembourg at 13pc (298).

They were followed by Frankfurt (12.9pc), Vienna (10.5), Paris (7.6pc), Rome (5.7pc) and Vilnius (5.5pc).

The results come as the European Commission last week opened the formal six-week bidding period. However, who ultimately makes the decision has not yet been decided. The European Council is so far rejecting attempts by the European Parliament to have the final vote on the location.

Meanwhile, the Compliance Institute in Ireland released a survey which polled more than 230 compliance professionals working in Irish financial services organisations nationwide on their thoughts about Ireland’s pitch to host the EU’s new anti-money laundering watchdog and what it could mean for the sector in the country.

The vast majority of those asked (86pc) believe that winning the bid to host the new authority will bolster compliance across the Irish financial services landscape.

Commenting on the survey findings, Michael Kavanagh, CEO of the Compliance Institute said: “Winning the bid to host the EU’s new anti-money laundering watchdog would be a major coup for Ireland. Not only would it boost – and create huge opportunities across – Ireland’s financial services sector, it would further enhance our reputation as a centre for strong regulation and enforcement and strengthen the perception of Ireland as a safe place to do business.

“Having the new AMLA headquartered in Dublin would also have advantages for the local and wider economy and see great employment opportunities for professionals living here,” he added.

“The new anti-money laundering watchdog will be a significant EU institution, tasked with supervision of obliged entities in the financial services sector in the first instance and eventually, those in the non-financial sector. So hosting the authority here would see some of the eurozone’s riskiest financial firms overseen from Dublin and see Ireland play a pivotal role in the EU fight against financial crime and money laundering. We believe Ireland is well placed to win this bid,” said Mr Kavanagh.

Further highlights from the Compliance Institute AMLA survey reveal that:

- Half (50pc) of compliance professionals working in the Irish financial services sector believe it “likely” that Ireland will win the bid to host the AMLA, while 5pc deem it “very likely”.

- Four in ten (40pc) believe it “unlikely” that Ireland will win the bid to host the AMLA, while 5pm deem it “not very likely”.

The call for bids says the locations should allow AMLA “to fully execute its tasks and powers, to recruit highly qualified and specialised staff, to offer adequate training opportunities for AML/CFT activities, where relevant, to allow for close cooperation with Union institutions, bodies and agencies.”

The chosen city must also “avoid reputational risks, to consider how ML/TF risks are adequately addressed in the Member State based on publicly available, relevant and comparable information such as FATF reports.”

Each Member State can nominate one city to host AMLA but can give three different office block options.

The bids have a deadline of 18.00 on November 10 next.

Last week the two MEP rapporteurs handling the file – Bulgarian conservative Emil Radev and the Spanish liberal Eva Maria Poptcheva said the anti-money laundering package and the AMLA are high on the EU’s political agenda and therefore they want to “provide citizens with a solid framework.”

The Council and parliament now have to agree on the final selection process, which may include joint hearings by the Council and the EP.

What is annoying MEPs however is that the technical specifications around achieving a balanced geographical distribution of EU authorities among Member States has still not been defined. Unless the EP can get its act in order, AMLA is likely to go to one of the bigger countries, particularly as it appears Spain and Germany have struck a deal to gift the authority to Frankfurt.

This could involve Germany agreeing to vote for a Spanish nominee as President of the European Investment Bank (EIB) – but that could come undone if Commission EVP and Trade Commissioner Valdis Dombrovskis throws his hat in the ring for the EIB job.

From last Thursday the Trilogue (co-legislators) agreed:

- the six-week deadline for applications. The Commission’s AMLA Task Force will then publish all the received bids online

- each country can only propose only one city and cite maximum of three potential office buildings meeting exacting criteria including likely benefits and immunities for AMLA and its staff

- AMLA Task Force to carry out general assessment of received applications and submit results to Council and European Parliament

We now know that there at least 10 countries which have signalled a desire to host AMLA with its expected 750 staff and up to 10,000 support jobs in banking, compliance and law enforcement. The 10 bidding nations are:

- Brussels

- Dublin

- Frankfurt

- Madrid

- Luxembourg

- Paris

- Riga

- Rome

- Vienna

- Vilnius

AMLA’s establishment is part of a broader initiative encompassing anti-money laundering and counter-terrorism financing measures, currently under negotiation between the Parliament and the Council.

To strengthen the European Union’s rules against money laundering and terrorist financing, the European Commission presented a package of legislative proposals on 20 July 2021.

To ensure that EU rules are applied correctly and consistently, AMLA will oversee at least four banks in each Member State and coordinate with Financial Intelligence Units in each country to improve their analytical abilities and make financial intelligence a key source of legal information.