By ALISHA HOULIHAN for AMLi

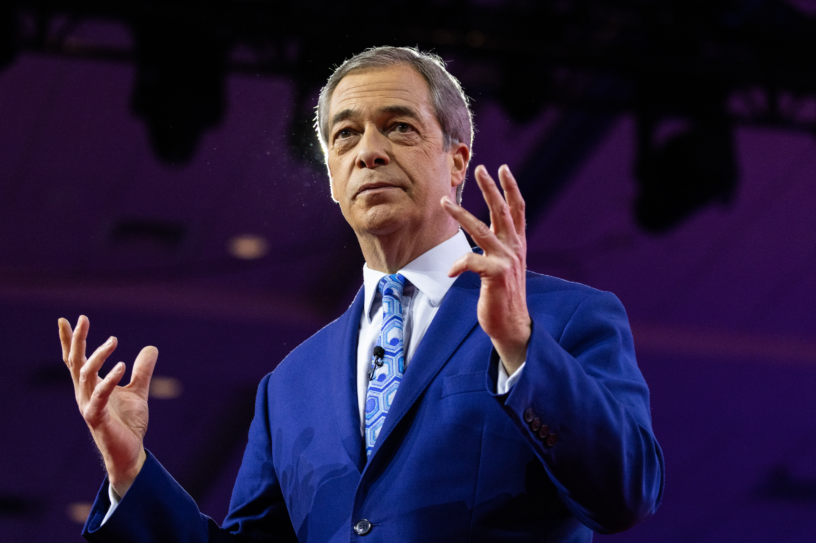

“Private financial firms have the right to bar customers who may pose a reputational risk due to involvement in criminality or corruption…. “this does not apply to Farage, however.”

So reads the editorial in the Financial Times today.

It is now quite clear that the decision by NatWest and its subsidiary Coutts Bank to shut down Nigel Farage’s bank account has opened the UK banking sector to justified criticism, over-reach and intense scrutiny.

It is also likely to lead to a suffocating deluge of Data Subject Access Requests from disgruntled customers. After it was Farage’s own DSAR which gifted him a copy of the indiscreet report from the Coutts’ reputational risk committee which recklessly disparaged his character. Whatever your political views, Farage is entitled to his opinions. Opinions that are within the law should not lead to a bank shutting down your account.

Earlier this month, AML Intelligence reported how British Brexit leader Nigel Farage produced the report on foot of the DSAR in which royal bankers Coutts astonishingly revealed it had closed his bank accounts because his views were not compatible with its values.

The bank’s internal report revealed his account was shut down because his views “do not align with our values” – rather than not meeting a financial threshold as previously reported.

It is quite clear that politicians, members of the opposition and the many people with whom your views do not align deserve bank accounts. As the FT says it “ought to be a statement of the obvious.”

“Regardless of what one may think of Farage’s views, the incident should cause unease in a country that prides itself on democratic values,” the editorial warns.

“Individuals have the right to lawful free speech, and banks, regulated by the Financial Conduct Authority, have a duty to treat customers fairly.”

“The Farage case also highlights a broader problem around how banks deal with high-profile customers.”

The Financial Times also urges authorities to work closely with the banking sector to “clarify the red lines.”

The Financial Conduct Authority (FCA) should, “re-emphasise that legally-held political beliefs are irrelevant in any decision on customers — and be ready to investigate and penalise banks that unfairly deny services to clients they disagree with”.

On Thursday, the UK government announced it would increase the notice period before accounts are terminated and require banks to provide more details.

Share this on:

Follow us on: