By Dan Byrne for AMLi

THE DAUGHTER of a wealthy South African property tycoon has been arrested in relation to money-laundering on a Revolut account.

The woman (53) was using Icelandic and UK identities and set up her Revolut account in Ireland using a British driving licence.

Police in Dublin said Farah Damji was questioned by detectives from the country’s Garda Economic Crime Bureau (GNECB) on suspicion of money laundering.

Although charged this week, she had been detained for several months before this after authorities found her that she had been living in Ireland under the false Icelandic identity.

For her extensive record of financial crimes, Damnji has previously been described as a “notorious con-woman,” in the Sunday Times.

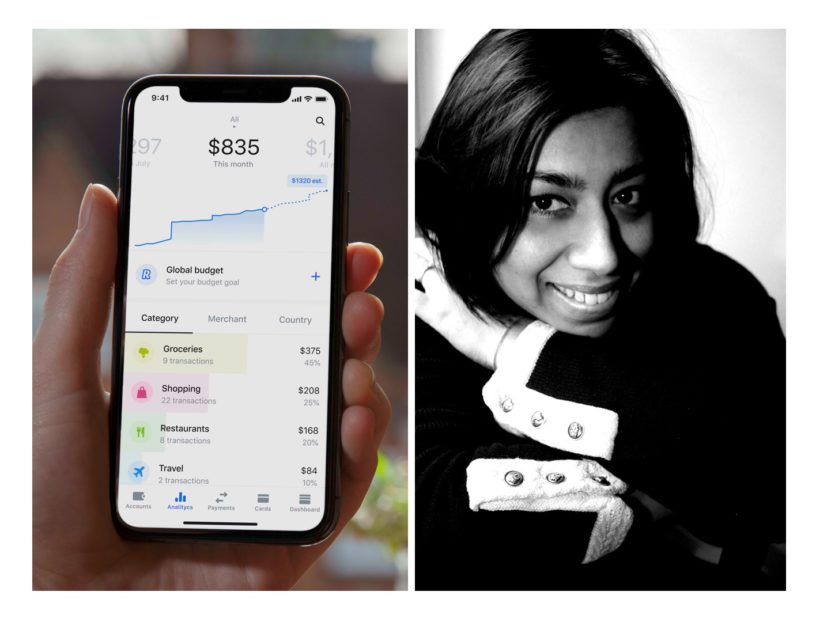

Revolut – the online banking platform allegedly used in her latest crimes – has seen user numbers grow exponentially since it began operations in 2016. In the past year, the figure has doubled from 6 million to 12 million.

The app-based platform requires many of the features common in the know-your-customer context to set up an account.

Full name, phone number and verified address are all essential, as is an image of some accepted form of photo ID. However, this can and does leave the system open to fraud, which Damnji was allegedly able to exploit.

Aside from her latest charges in Ireland, her extradition is also being sought by UK officials after she absconded three days into a trial there.

Born in Uganda to a wealthy South African property tycoon, her trail of activity is reported to have extended across the world – with charges and convictions in countries such as the US, UK and South Africa.

She has been accused of bank fraud, cheque fraud, grand larceny, altering official records, benefit frauds, as well as the stalking and harassment of two men in the UK – making excessive hoax phone calls to both of them and threatening their family members.

Investigations, charges and convictions against her stretch all the way back to 1995 – a 25-year criminal record.

Share this on:

Follow us on: