By Stephen Rae for AMLi

EUROPE’S new anti-financial crime agency will be known as the Anti-Money Laundering Authority (AMLA), it has been confirmed.

Significantly the authority will have an independent board which will take decision making out of the hands of national authorities. That has been one of the perceived weaknesses of the European Banking Authority (EBA) whose board is drawn from EU Member States. Critics said the structure made it near impossible for the EBA to deliver reprimands or hefty fines to banks based in Member States.

Plans for the AMLA will be unveiled on July 20 as part of a new legislative package from the European Commission. The authority will have direct supervisory powers to crack down on illicit finance across the union.

Moreover, the authority will be able to levy fines, with total penalties not to exceed 10 per cent of annual turnover or €10M – whichever is higher.

The AMLA will have a staff of 250 people but a headquarters location for the agency has not yet been decided – that will have to be ironed out in negotiations with Member States.

A report on AML Intelligence in January first revealed plans to the establish the standalone authority – which will assume many of the roles currently carried out by the European Banking Authority in Paris. MEPs have long argued that the EBA is too restricted by its banking role to supervise non-banking entities.

The AMLi report also flagged the outlawing of cash transactions beyond €10,000 and increased crypto surveillance, all of which are contained in the new legislation.

The memo says the new agency will scrutinise some of the EU’s “riskiest” financial institutions, as well as their national supervisors, in an effort to crack down on money laundering scandals that have plagued the bloc.

The supervisor is expected to directly supervise a small number of the “riskiest, cross-border” banks and financial institutions by 2026. The agency will be tasked with overseeing national AML supervision and will also have the power to slap non-compliant entities with multi-million euro fines.

“By directly supervising and taking decisions towards some of the riskiest cross-border financial sector obliged entities the Authority will contribute directly to preventing incidents of [money laundering and terrorism financing] in the union,” a memorandum accompanying draft legislation to be unveiled in two weeks says.

“It will co-ordinate national supervisory authorities and assist them to increase their effectiveness in enforcing the single rule book and ensuring homogenous and high-quality supervisory standards, approaches and risk assessment methodologies,” the memo says.

‘The AMLA will become the “centrepiece” of an integrated supervisory system also made up of national authorities’

EUROPEAN COMMISSION MEMO

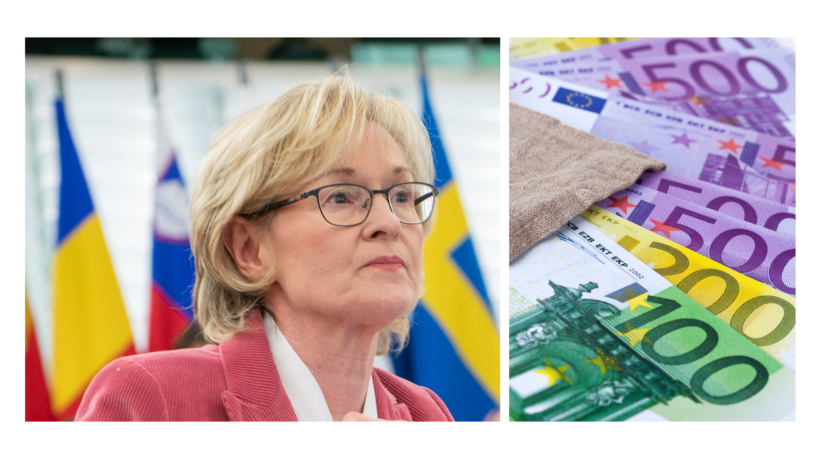

The Authority will be up and running by 2024, recruited its staff by 2025 and supervising from 2026, Financial Services Commissioner Mairead McGuinness told AML Intelligence in April. It will be financed by levies on financial institutions.

“Money laundering, terrorist financing and organised crime remain significant problems which should be addressed at Union level,” the memo says. The AMLA will become the “centrepiece” of an integrated supervisory system also made up of national authorities.

The body, according to the memo, will focus its efforts on large lenders who operate in at least seven EU Member States and are deemed “high-risk” by at least four.

At the same time, many of Europe’s biggest problems have been created by its smaller lenders including ABLV Bank in Latvia, FBME Bank in Cyprus, Pilatus Bank in Malta and scandal-ridden Danske Bank in Estonia.

The memo says smaller banks previously investigated for AML Breaches in one Member State and deemed to be “high-risk” by at least four others, will be subject to enhanced supervision by the watchdog, but most smaller lenders will escape increased scrutiny.

Financial institutions, lenders and other non-bank financial institutions that operate in at least 10 EU countries, who engage in “sufficiently risky” business will also be scrutinised.

The agency is set to update and publish a list of all institutions under direct supervision every three years. Member States will also be required to adopt a risk assessment to ensure that financial institutions with a significant cross-border operation and increased financial crime risks are selected.

Risks identified by the Supervisor include products and services offered, non-EU countries in which they are in operation and clientele base. Similarly financial institutions with a large number of foreign clients or PEPs may also be flagged as those who pose enhanced risk.

A further proposal will introduce new EU requirements for service providers in crypto-assets to collect and make accessible data concerning the originators and beneficiaries of transfers in those assets.

Transfers of such virtual assets are currently outside the scope of EU rules for financial services. “The lack of such rules leaves holders of crypto-assets exposed to money laundering and financing of terrorism risks, as flows of illicit money can be done through transfers of crypto-assets,” the document says.

Commissioner McGuinness told the AMLi Boardroom Breakfast Series event in April that the single EU rulebook and the single EU supervisor (the AMLA) would act both as a watchdog and a facilitator – ensuring national authorities took charge wherever appropriate.

The AMLA ‘will have a regulatory role. It will advise the Commission on AML risks outside the European Union, all under one roof’

EUROPEAN COMMISSIONER MAIREAD MCGUINNESS

“The AML Authority will have a number of different roles,” she explained, noting that it would be the “direct supervisor” of certain entities, but not all of them.

“It will coordinate and provide support to other FIUs,” she said. “It will have a regulatory role. It will advise the Commission on AML risks outside the European Union, all under one roof.”

In addition, she said, the authority would allow member states to come forward with their own proposals for extra rules, wherever they deem it appropriate in their national contexts.

Europol estimates the value of suspicious transactions at 1.3 per cent of GDP – or €160Billion.

The legislative package represents the EU’s boldest attempt to tackle illicit finance in the wake of scandals across the bloc.

The commission’s aim is to better harmonise regulatory practices, bolster co-ordination between national authorities, and improve cross-border flows of information between countries’ financial intelligence units. The new authority will also directly oversee the ‘riskiest’ financial sector firms which have operations in a number of EU member states.

The package will need to be hammered out between the European Parliament and member states, will also create a single EU rule book for anti-money laundering and terrorism finance, as well as new rules on crypto assets.

A report from the European Court of Auditors last month warned that much more needs to be done to ensure EU law in the area is implemented “promptly and coherently”, and that the current oversight framework is “fragmented and poorly co-ordinated”.

Scandals in the banking sector have included when US authorities uncovered institutionalised money laundering at the now-defunct Latvian bank ABLV in 2018 .

Further scandals have included suspicious transactions through Danske’s Estonia branch between 2007 and 2015.

OUR KEYNOTE IS JOHN BERRIGAN, DIRECTOR GENERAL, DG FISMA, EUROPEAN COMMISSION; JOINED BY JESPER BERG, DG, FSA, DENMARK; AND VIVIENNE ARTZ, CHIEF PRIVACY OFFICER, LONDON STOCK EXCHANGE. BOOK YOUR TICKETS ON OUR EVENTS PAGE.