By PAUL O’DONOGHUE, Senior Correspondent

FINCEN, the AML unit of the U.S. Treasury, has warned banks of Chinese money laundering networks (CMLNs) working with Mexican cartels.

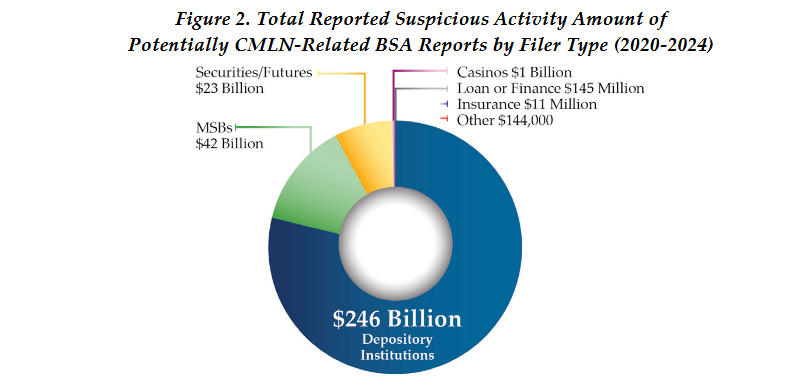

A new advisory from the organization said CMLNs are suspected to be linked to as much as $312 billion in illicit activity between 2020 and 2024.

It also provided a ‘Financial Trend Analysis’, highlighting the scope of CMLN activity in the U.S.

It recommended that banks should be on the lookout for signs of suspicious activity from Chinese passport holders.

A ‘red flag’ for potential money mule activity was described as: “A customer, especially a customer who presented a Chinese passport as identification during the onboarding process, regularly receives funds that are not commensurate with the reported occupation or income.”

FinCEN warned of another potential risk during onboarding. “A customer presents a Chinese passport and a visa that contain the same photograph despite being allegedly issued years apart,” it said.

The notice is available to read in full [HERE].

Risk of Chinese nationals and cartel laundering

John Hurley, the Under Secretary for Terrorism and Financial Intelligence, said money laundering from CMLNs “enables cartels to poison Americans with fentanyl”.

“[They also] conduct human trafficking, and wreak havoc among communities across our great nation,” he said.

The notice said FinCEN analyzed over 137,000 Bank Secrecy Act (BSA) reports filed by financial institutions between January 2020 and December 2024.

It said this is “the dataset associated with suspected CMLN-related activity, totaling approximately $312 billion in suspicious transactions”.

“CMLNs are professional money launderers. [They] are heavily utilized by Mexico-based cartels to launder drug proceeds in the United States,” the advisory said.

“U.S.-based CMLNs may sell U.S. dollars purchased from Mexico-based drug cartels through advertisements on social media. Or by leveraging personal networks involving Chinese citizens and/or businesses.”

FinCEN Director Andrea Gacki added that Chinese networks laundering cash for cartels are “global and pervasive, and they must be dismantled”.

“These networks launder proceeds for Mexico-based drug cartels. [They] are involved in other underground money movement schemes within the U.S. and around the world.

“FinCEN’s analysis supports the Treasury’s continuing efforts. To bankrupt transnational criminal organizations and their enablers.”