By Omer Frenkel

Decision Intelligence at Cognyte

IN THE HIGH-TECH internet age, criminals frequently leave behind digital footprints that help guide law enforcement agencies (LEAs) and financial regulators to connect the dots during investigations. Ironically, it’s the low-tech crimes perpetrated offline that are typically the most puzzling for authorities.

This is exemplified in the recent surge in money laundering and criminal activity facilitated via Hawala money brokers practicing a money transfer system that dates back centuries. LEAs worldwide have been largely blocked in their efforts to combat the illicit and decidedly low-tech movement of funds between Hawalas across a decentralized and largely unregulated network of brokers.

Hawalas mostly avoid the frills of traditional banks and offices, and their transactions are often contained to paper notebooks scrawled with mysterious codes and token numbers denoting transactions between anonymized parties.

On its own, the investigative value of a Hawala ledger is practically nil – the money trail is blurred beyond recognition – giving investigators precious little to go on. But LEAs have to start somewhere, and there’s a growing global impetus to act with urgency on illicit Hawala activity. The high-tech domain is answering this challenge with AI-guided decision intelligence capabilities to help surface meaningful investigative insights from origins as low-tech as the coding of the Hawaladar’s notebook.

HOW HAWALAS WORK

Since the Middle Ages, Hawalas have practiced an off-the-books method of remittance that sidesteps traditional banks and regulators, relying instead on networks of brokers coordinating money transfers in a system underpinned by a strict honor code. Trust is the ultimate currency among Hawaladars.

Hawalas, a type of international controller network (ICN), are particularly popular among migrants transferring money to/from families back home, and in regions underserved by traditional financial institutions, or where trust in established institutions is eroded. With foundations in the Middle East, Asia and parts of Africa, Hawala networks have also spread to Europe, the Americas and elsewhere in recent years.

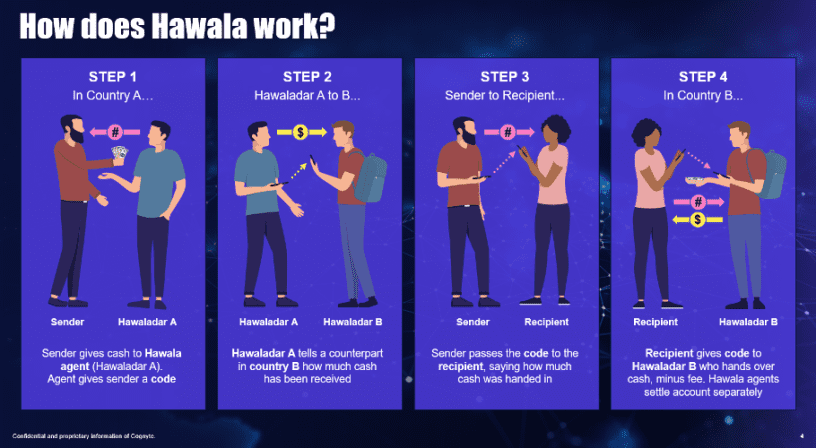

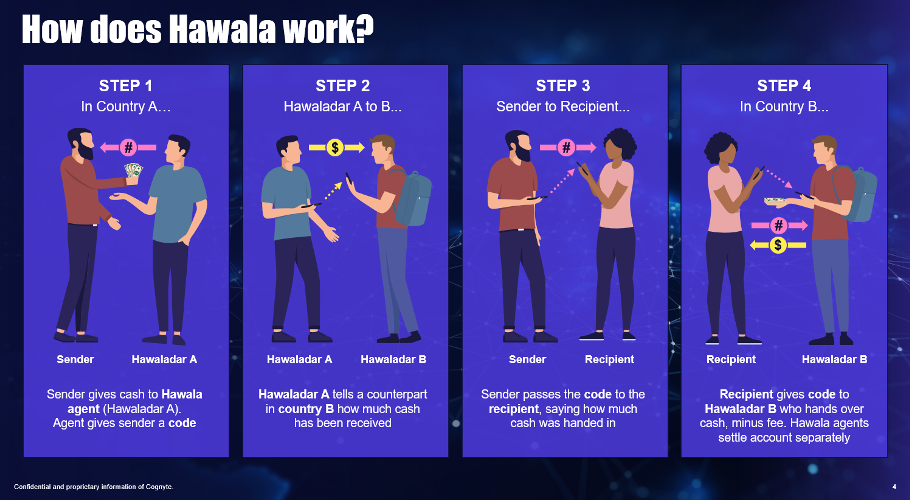

In a typical Hawala transaction, a broker will accept money in one country and instruct a trusted broker in the destination country to distribute the same value in funds to the end recipient. The Hawaladars act as intermediaries in these transactions, settling the debt between themselves and subtracting a small fee. This process enables the transfer of value between countries without actually moving any funds.

It’s important to understand that Hawaladars provide a vital service in some regions, particularly in Muslim communities, where the charging of interest on financial transactions is prohibited according to Islamic law.

Hawalas also typically provide a more cost-effective means of money transfer compared to traditional wire services, preserving hard-earned wages for workers and their families. Moreover, Hawalas often play a valuable role in bridging diasporas together by leveraging trusted intermediaries.

The off-the-books nature of Hawalas makes them inherently susceptible to misuse by organized crime groups and other criminal actors, including money launderers, drug traffickers, migrant smugglers and terror networks. Left unchecked, this misuse will only accelerate.

This misuse of the Hawala system triggers a discussion whether to bring Hawalas into the financial mainstream, as an opportunity to enhance regulation and compliance among legitimate Hawaladars in a manner that respects cultural differences, or to combat it to the point of encouraging those that rely on this financial system to shift to the “regular” financial system.

Where migrant smuggling is concerned, it’s estimated that between €300 and €700 million in illegal proceeds moves through Hawala networks annually across central and western Mediterranean routes. In Afghanistan, which supplies 80% of the world’s opium, Hawala is the preferred method for international money transfers. In Western Europe, it’s estimated that proceeds from drug trafficking funneled through Hawalas can reach up to €1 million per month!

CONNECTING THE DOTS WITH DECISION INTELLIGENCE

By approaching Hawala activity through the lens of a decision intelligence platform, investigators can begin to pull the thread that untangles the bad actors from the well-intended Hawaladars – but there are significant challenges, and the thread reaches across continents.

Among the data-centric challenges, investigators grapple with massive amounts of data from bank accounts, police records, and money exchange registrations, often siloed between multiple databases. There’s often little time to investigate each lead, and a significant volume of noise generated from false positives.

This in turn poses challenges at the decision-making layer. Which transactions or Hawaladars should investigators focus on? Which Hawalas pose the most risk for money laundering and other illicit transactions? How best to allocate and optimize financial investigation resources amid these priorities?

A decision intelligence platform can help overcome these challenges by using data fusion and analytics to reveal illicit Hawala activities, assess potential risks and accelerate decision-making. Machine learning-based analytical insights can be applied to better understand the money recipients and the funds used, for example, and investigators can use this data to outline the contours of Hawala networks and gain perspective into the network hubs over time.

It’s essential for the underlying investigative data to be fused and centralized in a unified workspace, with the ability to ingest and analyze structured data (databases, tables, etc.) as well as unstructured data (images, video, audio and handwritten text), extracting important content and meta data that enriches the profile.

This in turn can be correlated with call data records (CDRs), police reports, company registries, border control records and more, and combined with open-source financial data and web intelligence to help deanonymize participants across the Hawala network.

Decision intelligence enables a Hawala network to be digitized and visualized for investigators, automatically establishing relationships and linkages that manual investigation might take years to uncover – if they’re ever uncovered at all. With a better understanding of Hawala activity patterns, a fuller investigative picture can be developed that reveals key inroads for identifying and disrupting bad actors.

In the beginning, a Hawaladar’s notebook may be all there is to work from. But it can be digitized, and the data fused, analyzed and correlated via decision intelligence technology until the cypher is ultimately decoded, and the illicit activity laid bare.

The digitization of the Hawala system will help financial investigators in two key ways. The first is the ability to cross-check the data itself with other data sources to confirm legitimate transactions. Second, the digitation process will allow connectivity to the banking system, which will apply regulation, produce suspicious transaction/activity reports when needed, and streamline the investigations that are currently being done in a siloed manner.

THE AUTHOR: Omer is Product Marketing Manager of Decision Intelligence at Cognyte. He brings extensive experience and know-how in the intelligence field, with a decorated tenure of over 18 years as an intelligence analyst, department head, and product manager in the Israeli research National Unit. Omer holds a B.A. in International Relations & Middle Eastern Studies and an M.A, in Political Marketing.

Find more information on Cognyte HERE:

Share this on:

Follow us on: