The new rules will require KYC procedures for all cryptocurrency transactions and apply to all crypto companies operating services in France.

By Vish Gain for AMLi

France has unveiled plans to make KYC procedures compulsory for all cryptocurrency transactions in the country following a sweeping set of changes to its regulations announced Wednesday.

The changes include compulsory KYC requirements for all crypto companies operating in France, including companies not based in the country. Crypto-to-crypto exchanges will also have to be registered, something only required of crypto-to-fiat exchanges until now.

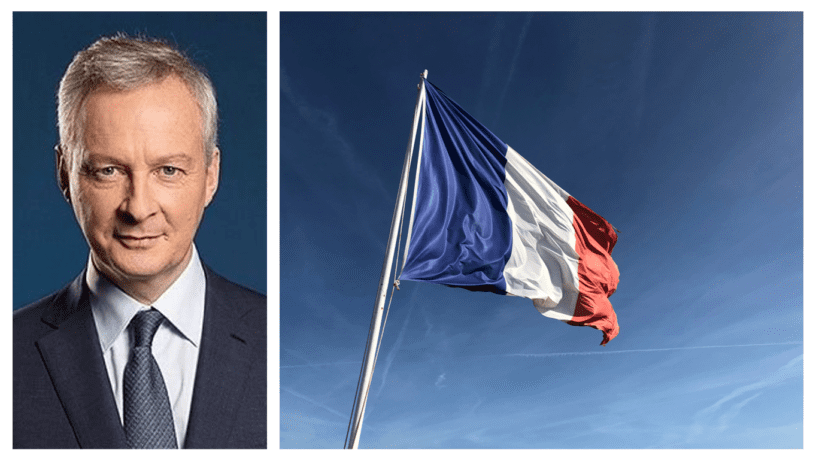

The announcement was made by French Minister for Economy, Finance and Recovery Bruno Le Maire in a tweet and detailed in a government press release Wednesday. The story was first broken by digital asset news outlet The Block.

The move is part of a larger national effort to fight money laundering and terrorist financing after French police arrested 29 individuals in September linked to a complex financing scheme of Islamist extremists in Syria using cryptocurrencies.

“We must drain the euro from all terrorist financing channels,” Le Maire declared in his tweet.

According to a statement from the anti-terrorism prosecutor’s office, French extremists who have likely been in northwest Syria since 2013 are suspected of creating “the architecture of this network of terrorism financing.”

In October, Le Maire said on national television that the country would make proposals “to strengthen the control of financial funds” because “cryptocurrencies pose a real problem of terrorist financing.”

The government press release cited the recommendations of the Financial Action Task Force, G7 and G20 as inspiration for the updates in regulation.

President of French crypto association ADAN Simon Polrot told The Block the inclusion of crypto-to-crypto transactions for KYC rules is “harsher than other jurisdictions”. He said the scope of the measure was also not clear, meaning it remains to be seen whether global crypto exchanges operating in France will also be brought under this rule.

However, Le Maire’s press release read: “In order to reduce the risks that could be borne by European players exercising in France under the freedom to provide services and avoid any distortion of competition, this order confirms the obligation of registration requirements applicable to foreign players wishing to target the French market.”

The measures are in the ordinance stage now, and will soon become a decree — the rule of law in France — and will therefore not go through any parliamentary approval process. Once it is a decree, all crypto firms will have six months to comply with the rules before law enforcement can start taking action.

Share this on:

Follow us on: