Steps the EU must look at in light of the FinCEN leaks. A balance between lessons from the past and current regulation

The FinCEN Leaks have dominated the world of financial services all this week – and now all eyes turn to the regulators and what happens in response.

Given the large involvement of European financial institutions, it is interesting to look into the plans of the EU and whether they may be affected by the new information from the FinCEN leaks around money laundering and terrorist financing.

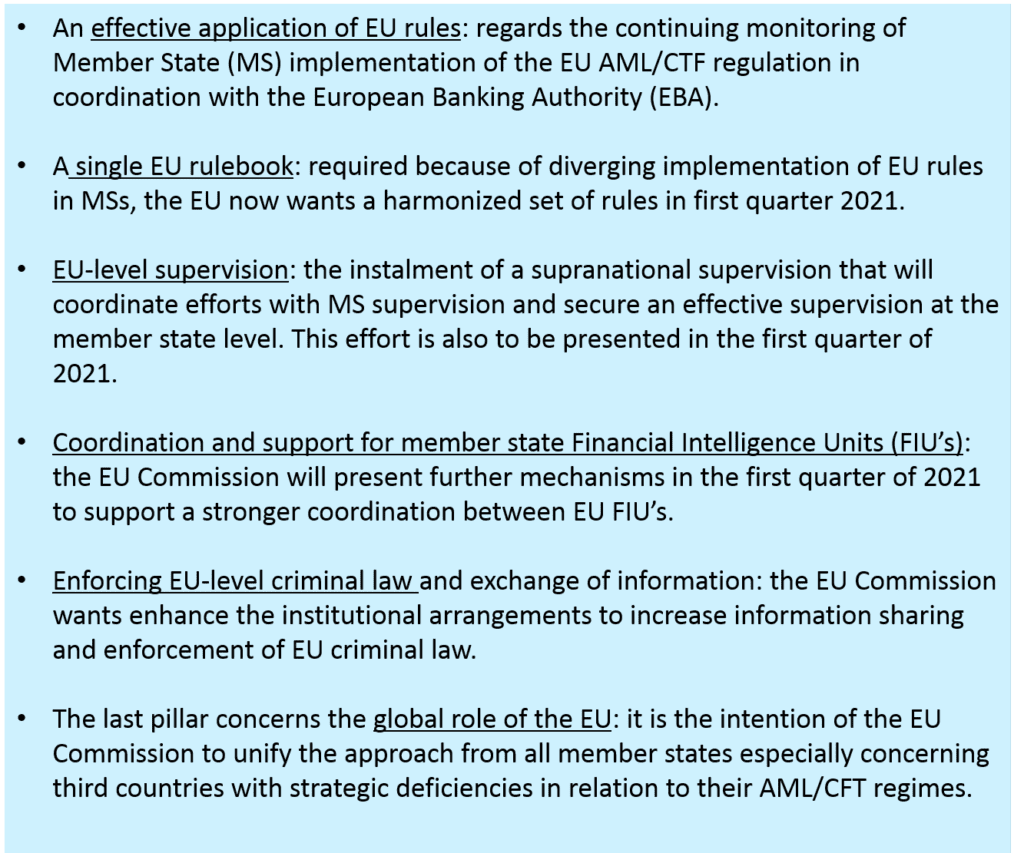

In May 2020, the EU Commission presented its action plan for the forthcoming initiatives in anti-money laundering and counter terrorist financing (AML/CFT). The political and structural initiatives concentrate around six core pillars:

These six pillars constitute the political approach of the EU Commission. Therefore, it is not finalised in terms of the actual impact and efforts, and there are still uncertainties and lack of clarity. For example, it is not clear if the EU will differ from the previous use of directives and instead aim for a regulation comparable to the General Data Protection Regulation (GDPR).

Another problem concerns the EU-level supervision and whether this new agency is to operate in accordance with the EBA and other supranational authorities.

It is puzzling that the EU still finds a need for stronger FIU cooperation since that was one of the sole aims of the fifth directive on the prevention of money laundering and terrorist financing (5AMLD) implemented in January last.

The same problem arises in terms of the enforcement of EU-level criminal law. In the sixth directive concerning anti-money laundering, the EU enhanced its efforts towards a baseline in criminal law. However, the specific text of the directive mostly constitutes existing obligations under the Warsaw Convention (2005) and the FATF recommendations, giving no new insight on the actual efforts in increased enhancement by the EU. Given that the sixth directive has its transposition date on October 1 2020, are we to expect a higher enforcement of sanctions on crime?

Another example of the imprecise aspects of the EU action plan is the focus of EU as a global unified player. As noble as the aim of this unification is, it still does not explain to which extent the EU will regard significant strategic deficiencies in its own member states, such as Cyprus or Malta.

With the six pillars, the EU Commission has presented its political approach to the prevention of AML/CFT. However, it is clear that the pillars are no by no means complete in the regulatory scope or impact. It is worth asking, will the recent FinCen leaks have an impact or a say in the coming structure of the EU AML/CFT approach and mechanisms?

It is important to keep in mind that the implementation of the fourth, fifth, and sixth AML/CFT directive of the EU has happened after the timeframe of the FinCen leaks. However, what the FinCen leaks show is crucial for the future of the EU efforts.

- It is clear due from the FinCen leaks that the problem is of international character. Hence, there is a strong argument for leading the EU Commission towards a primary regulation like the GDPR in the EU. The international dependency of money laundering and terrorist financing constitute a clear argument that a regulation will also be in line with the subsidiarity principle. The FinCen leaks should therefore push an agenda that politically has been difficult during the last decade, ie to give the ultimate regulatory power to the EU level instead of member states transposing minimum directives.

- The FinCen files have shown a deficiency in the crucial link between supervisors, FIUs and the financial entities. The EU should on the basis of these findings consider to incorporate the EU-level supervision and the cooperation of the FIU’s in a so-called public-private-partnership with the EBA and the rest of the ESAs. This would lay the foundation of how the member states can enhance and organize the national partnerships between the authorities and the financial institutions. All of course, with the “arm’s length” principle in mind.

- It is crucial to consider, whether this new agency should operate outside of the political agenda of the EU. This concerns pillar number five and six and the lack of deterrence in the sanctioning level disclosed by the FinCen leaks. If supervision, reporting, and intelligence services have to function effectively, the system has to be equal in terms of law enforcement. Sanctioning has to be excluded from political agendas. The law is the law. This must mean certain jurisdictions and certain financial entities will be hurt financially and responsible persons might go to prison. It has been the core of the fourth, fifth, and sixth anti-money laundering and counter terrorist financing directives that the sanctions should have deterring effects and the regulatory scope has increased the frame for sanctioning. Simply put, we need to see more enforcement – especially in the light of recent FinCen findings.

The FinCen leaks show the magnitude and reality of money laundering and terrorist financing and the relation to organized crime, which politicians have not experienced prior to the same extent.

It should have an impact on the next steps by the EU. The FinCen files most of all highlight the extraordinary scale of criminal activity and display how big the scale of effort required by the financial system to combat money laundering.

We must expect harder impact and efforts from the EU in terms of both regulatory and law enforcement measures.

It will be interesting to observe developments the EU conference next week, when the EU will discuss its action plan.

- THE AUTHOR: Kalle Johannes Rose, PhD is Assistant Professor in financial law and economics, CBS Law at Copenhagen Business School, Denmark. His present key research area is: Law and economics of Money Laundering in the EU. Kalle has previously worked for the Danish FSA (Office of Governance, Money Laundering and Payment Services). Before that he completed a Ph.D. in law and economics at Copenhagen Business School with research stay at UC Berkeley. kr.law@cbs.dk

References:

The EU Commission’ action plan: https://ec.europa.eu/finance/docs/law/200507-anti-money-laundering-terrorism-financing-action-plan_en.pdf

Information regarding the coming conference on the action plan: https://ec.europa.eu/info/events/finance-200930-anti-money-laundering_en

Share this on:

Follow us on: